People in the US are now applying for unemployment claims, and the global economy feels the effect of coronavirus, believe it or not, the world’s richest man just got a little richer.

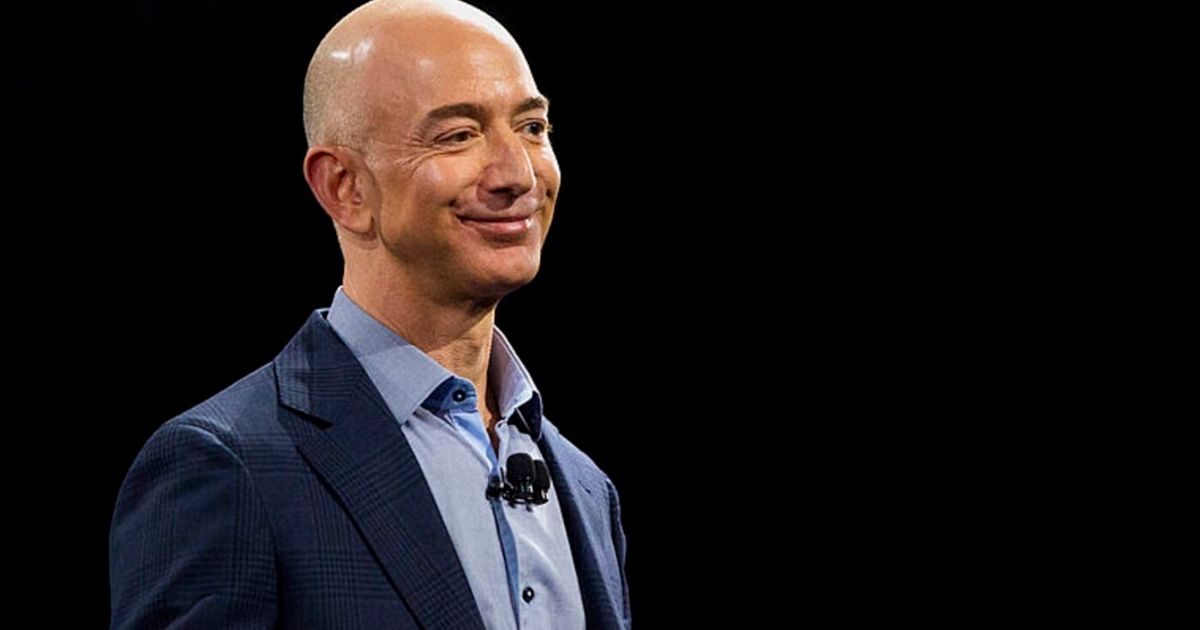

Amazon CEO, Jeff Bezos, has a higher net worth than anybody else on the planet – currently standing at a whopping $117 billion, far ahead of, Warren Buffett, Mark Zuckerberg and Bill Gates.

The COVID-19 pandemic hit a significant surge at the turn of March – currently, there have been more than 600,000 confirmed cases worldwide. Whether it be quick-thinking or dumb luck, Bezos has made a pre-crisis financial monetary mountain.

On February this year, before the full scale of the coronavirus outbreak was readily apparent, the 56-year-old figurehead sold off $3.4 billion worth of shares just before the stock price peaked but more importantly, ahead of the market collapse.

On March 26, Bezos’ fortune even soared by $3.9 billion to a whopping $120 billion after a three-day market rally ratcheted up Amazon’s share price back to a decent $1,920 (just down from the first week of February). He currently owns around 12% of the company’s shares.

There is absolutely no evidence to suggest Bezos had the upper-hand via a tip-off. However, his timing was bang-on-the-money.

According to a report from The Wall Street Journal, his share sales on this occasion matched the amount sold throughout the past 12 months, representing around 3% of his total holding.

Please note, the Amazon boss wasn’t the only tycoon to duck out. Larry Fink, the chief executive of fund manager BlackRock, managed to prevent potential losses of $9 million, while Lance Uggla, CEO of data firm IHS Markit, sold $47 million of shares ahead of their price-drop to $19 million.

Bezos recently wrote a letter to his employees thanking them for their hard work, while noting he is working closely with the World Health Organization to brainstorm ways of supplying COVID-19 tests around the globe. Bezos also announced that Amazon will be hiring for 100,000 positions to assist those in need of work amid rampant job losses.