President Joe Biden is all set to announce a major infrastructure plan worth up to $4 trillion and that means a surge in tax rates.

According to media reports, the President is gearing up to unveil his new infrastructure package tomorrow, which will take place in Pittsburgh. Therefore, members of the Biden administration have been working hard in terms of coming up with tax hikes that will pay for it, comprising of around $3 trillion.

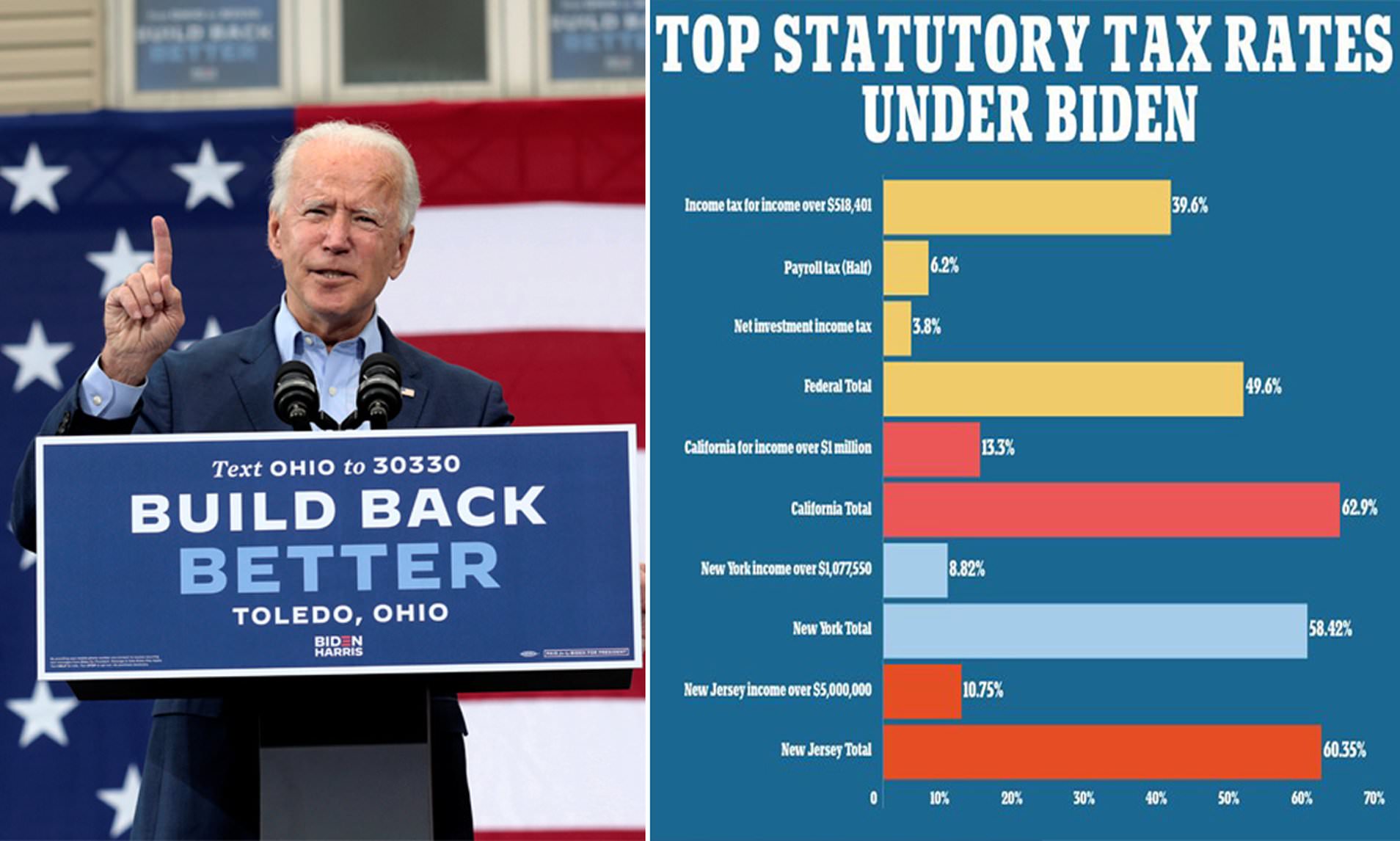

As far as the major surge in taxes is concerned, experts warned how the hikes will primarily target both the rich as well as middle-class citizens. In particular, it was reported how they could severely hit those Americans earning more than $400,000 in a year, alongside businesses, estates, and the majority of married couples.

The shocking news comes as a part of the president’s bid to fund all the revenue required for his extremely bold purpose of paying for new bridges, green technology, new roads, and a clause referred to as ‘human infrastructure’ too.

This will include all the subsidies that Americans will be required to pay in terms of health insurance as well as the different measures needed to eliminate child poverty too.

In total, the increases could potentially reach a total of over $3 trillion, as reported by the Washington Post. And that makes sense as the infrastructure plan itself is worth $4 trillion. Critics following the infrastructure plan carefully warned how the rest of the funds needed would need to be borrowed.

One prime example of a major hike that the president campaigned for was raising the corporate tax rates from 21% to 28%. Meanwhile, Donald Trump had signed legislation that dropped this rate to its current level from a staggering 35%.

One tax expert reported to Fox News how individuals earning less than $400,000 would get hit, in case they plan on filing taxes jointly, alongside their spouse. In the same way, the expert also mentioned how the news was a huge disadvantage for those couples that were married. He called it a ‘marriage penalty,’ and said it was nothing new in terms of the tax system.

Whatever the case may be, the news is likely to create a heated debate among plenty of Republicans, economists, Democrats, as well as academics in terms of what is the right way to actually plug holes in the current US economy.